You’ve been messing and toying with the brightest minds since 1792, when the New York Stock Exchange was created under a buttonwood tree on Wall Street. Your latest bull market run has as many investors as puzzled as it does nervous. The longer we go on without a stock market correction the potentially worse it will be when it eventually hits. At this point, it’s clearly not a matter of “if” but “when” it is coming. Continue reading

Tag Archives: Asset allocation

Under Armour (UA) – Buy, Sell or Hold?

Throughout 2014 consumers have proven that they can be extremely fickle, looking for superior products at the best possible price. They have been very selective how they spend their hard-earned money forcing companies to be both creative and resourceful. When looking at consumer discretionary companies returns have been all over the board, separating the contenders from the pretenders. For a company to be successful they must provide a superior product with quality service at a competitive price. When it comes to the sporting goods/apparel industry there is a relatively young company that has emerged as a leader and is playing ball with the big boys.

Under Armour (UA) has burst onto the sports/fitness industry scene over the last decade. With bold marketing and innovative products they have become a force and have caught investors attention. UA is up over 34% YTD and has left many of its competitors in the dust: Nike (NKE, YTD =-1.87%), Lululemon Athletica Inc. (LULU, YTD = -33%), Adidas (ADDYY, YTD = -24%) and Columbia Sportswear (COLM, YTD = +3%). With impressive numbers like this investors are forced to ask themselves if the stock still has positive upside or if it is too late to take a position? Continue reading

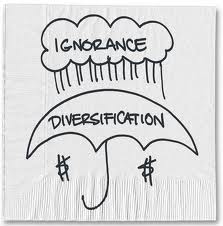

3 Common Diversification Mistakes

Whether you handle your portfolio or hire a professional to manage it, there is no way you have not heard of the importance of diversifying your investments. The reality is, however, most investors fall prey to one of three major diversification mistakes; which of the three is your issue?

First and foremost, let’s briefly review what diversification is:

Investopedia defines Diversification as: ‘A risk management technique that mixes a wide variety of investments within a portfolio. The rationale behind this technique contends that a portfolio of different kinds of investments will, on average, yield higher returns and pose a lower risk than any individual investment found within the portfolio.’

At first glance this makes sense and doesn’t appear to be complex, right? We find that investors typically appear to be in one of three different camps when it comes to diversification:

- Under Diversification

- Improper Diversification

- Over Diversification

Let’s take a moment to look at each and how investors can get their portfolios back on track. Continue reading

InvenSense (INVN) : Motley Fool’s Secret Wearable Technology Stock!?

Technology is a bit like true love. You have to believe in it but it can also bite you in the ass.

Read through this article and you’ll see how this relates to a particular investment!

The technology Industry can be a challenging sector for investors. Perhaps the best way to describe it is with a popular saying … “the one constant is change itself.” Plenty of analysts and investment firms scour through stock ticker symbols looking for the next Apple (AAPL), Amazon (AMZN) or Google (GOOG).

We couldn’t help but notice the Motley Fool’s recent …shall we say, “stock pitch” about a company that could be your next homerun! If you’re a die-hard Apple fan, wouldn’t you like to know who their next HUGE inside supplier is? Rewind the clock and take for example the desktop computer or the cell phone you have within inches of your hand right now…

Put Apple, Sony or IBM on the shelf for a minute and think about investing in the next company that has a stake in every sale regardless of the brand you choose? In other words, buy the “chip” or technology that’s inside of each device instead of trying to figure out which phone or computer manufacturer is going to win the battle. Continue reading

MPG Core Tactical 60/40: April 2014 Performance Update

Unless you’ve never picked up a financial magazine or read the business section of any newspaper, you have undoubtedly heard of the old investment adage “Sell in May and go away”. Many financial “experts” and journalists do their best to paint the summer months as those that are primed to underperform. Does history always repeat itself in exactly the same way? Nope. It’s not hard to find investors who sold last spring (or even the one prior) in anticipation of a nasty summer and they are still in cash or underweight equities. If you’re in that boat and don’t trust the stock market, you may sleep better at night for now but in the interim you’ve lost opportunity cost and missed another bull market.

The flip side to this is that bearish investors will eventually be right! The S&P 500 has not had a correction of -10% or more since October 3, 2011. Like many investors out there we firmly believe a correction of -10% to -20% is coming this year but we don’t think it will be the start of a bear market. The challenge behind all of this, however, is that the longer we go without a healthy correction the deeper and more severe the inevitable sell-off will be. Continue reading

Top Tax Tips for 2014

Your whole world is about investing and the stock market. Stick to what you’re good at, and leave things like repairing your car, fixing that leaky faucet, or doing your taxes to someone else-

(1) Don’t take investment advice from a CPA and vice versa.

Notice how we practice what we preach. Our first “tax tip” will be to let you know that for specific tax advice you should NOT go to your investment advisor. We’re not CPA’s and even though we understand a great deal about taxation (specifically with regard to investments) our job is to manage investments, not tax codes.

Why is it then that we see so many accountants, tax preparers, CPA’s, and even “enrolled agents” dole out investment advice around this time of year? Investors naturally gravitate to the professional that sees the majority of their financial house and by default it’s typically a CPA. We’re not bashing CPA’s but allow us to be crystal clear on this point: A CPA has no formal training nor better understanding of investments or the portfolio strategy you or your financial advisor has put together.

Look to Tip #2 on what your CPA should know about your investment situation:

(2) If the introduction hasn’t been made yet…Make it happen!

In the case of investments and taxes one old adage couldn’t be more true: ”The right hand should always know what the left hand is doing.”

If your investment advisor has not met or interacted with your CPA an introduction needs to be made. They don’t have to become best friends but your overall financial situation will be enhanced when key professionals that help you know each other.

(3) What type of tax professional do you need?

Do you simply need Continue reading

MPG Core Tactical 60 /40: March 2014 Performance Update

March has turned in another month of stubborn market defiance as the investment world is waiting for a correction yet it never seems to come or fully develop! It’s without question that many of the warning signs continue to lurk below the surface but the S&P 500 has still managed to tack on about another +1%. Year to date we’re just about 1% of where we started 2014 but it sure feels uncomfortable for many.

If this is your first time reading about our MPG Core Tactical Portfolio please refer back to our first post. (click here) In short you will see what adjustments we make throughout the year on a $1 million dollar portfolio and how that performs relative to a portfolio that is rebalanced once per month with an allocation of 60% Stocks and 40% Bonds. Continue reading

Update: March Madness: Final Four Investing Bracket 2014

The 2014 NCAA Basketball Tournament certainly had an eventful weekend! 52 games have been played across the country with 5 of them going into overtime. The $1 Billion that Warren Buffett offered to anyone that had a perfect bracket is now a distant memory. Every year there are plenty of surprises and this year has been no different:

The 2014 NCAA Basketball Tournament certainly had an eventful weekend! 52 games have been played across the country with 5 of them going into overtime. The $1 Billion that Warren Buffett offered to anyone that had a perfect bracket is now a distant memory. Every year there are plenty of surprises and this year has been no different:

- 3 of the 4 teams that were seeded as #12 in their brackets posted wins over teams seeded #5! The one team that lost was beaten by only 3 points in overtime!

- #1 seed and ‘media darling’ Wichita State lost to #8 Kentucky in the 2nd round.

- The 2 longest winning streaks in the country have both come to an abrupt end – Wichita State with 35 and S.F. Austin with 29.

Here are some other mind boggling numbers to take into consideration with the NCAA Tournament:

- The odds of winning Buffet’s $1 Billion prize was 1 in 4,294,967,296!

- It is estimated that Vegas takes in over $100 Million from bets on the NCAA Tournament – experts think this represents only 4% of all the money wagered on games!

- The NCAA tournament costs businesses $1.7 Billion in lost productivity during the month of March.

What’s my number?? – Making sense of Financial Planning

Let’s be honest… the vast majority of hard working Americans have one question in common – Will I be able to retire? The circumstances pertaining to each individual are as different and unique as the individual themselves. The one connecting point we all have however, is to know if we are going to be able to reach our goals, whatever they might be.

Have you seen some of the commercials where an actor asks you if you know how much you need to retire? Other commercials have people carrying around a huge cut-out of a random numbers …like $1,456,298 around with them. What’s your magic retirement number? Where should an individual go to get his or her many questions answered? With few guarantees how is anyone to know if they are on track to reach their goals?

There is certainly not a lack of financial planning services and products available to consumers today. It can actually be a bit overwhelming and frustrating for the average person. Any Financial Plan should be viewed as a guide or a benchmark, serving as a road map to the ultimate destination. As with other financial service offerings there are many different elements that need to be taken into consideration. Let’s take a moment to look at some of the more important ones and put it in plain English using some common phrases we are all familiar with….. Continue reading

The New “MyRA” … A Direct Route To Retirement Or A Bad Detour?

Dear Mr. Market:

If you ask the average hard working American what their top financial concern is, it’s that that they won’t be able to retire. We could certainly go on and on about different solutions and how people can get on track to make their dreams a reality but today we will focus on a new program offered from the government. On January 29th President Obama delivered his State of the Union address. One of the takeaways from this speech was a new retirement account called MyRA (short for My Retirement Account).

Currently over half of the U.S. workforce is not covered by a retirement plan through their employer. MyRA is targeted at low to middle-income workers, encouraging them to save for their own retirement. Contributions will be funded through automatic payroll deductions where individuals can start with as little as $25 and contribute amounts as small as $5. Individuals would be guaranteed that their account would never go down and they will not pay any fees on the accounts. Sounds like a great product doesn’t it?! Well let’s take a step back and dig a bit deeper to really explore what the MyRA is all about….

The MyRA can essentially be viewed as a way to introduce individuals that have not saved or funded a retirement account to the many long-term benefits of doing so. At this point companies are not required to be involved in the program, if President Obama wants to force employers to participate a vote from Congress would be required. The accounts would be funded with after tax dollars much like a Roth IRA. While it will be funded with payroll deductions individuals will be able to keep their accounts when they change jobs. MyRA is subject to Roth IRA income and contributions limits. Individuals can invest up to $5.500 per year (or $6,500 for investors 50 or older); once the owner reaches the age of 59 ½ they can make withdrawals tax-free. There are also no required minimum distributions (R.M.D.’s). Continue reading