Let’s be honest… the vast majority of hard working Americans have one question in common – Will I be able to retire? The circumstances pertaining to each individual are as different and unique as the individual themselves. The one connecting point we all have however, is to know if we are going to be able to reach our goals, whatever they might be.

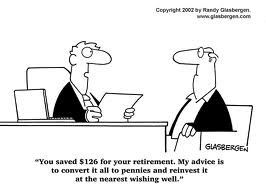

Have you seen some of the commercials where an actor asks you if you know how much you need to retire? Other commercials have people carrying around a huge cut-out of a random numbers …like $1,456,298 around with them. What’s your magic retirement number? Where should an individual go to get his or her many questions answered? With few guarantees how is anyone to know if they are on track to reach their goals?

There is certainly not a lack of financial planning services and products available to consumers today. It can actually be a bit overwhelming and frustrating for the average person. Any Financial Plan should be viewed as a guide or a benchmark, serving as a road map to the ultimate destination. As with other financial service offerings there are many different elements that need to be taken into consideration. Let’s take a moment to look at some of the more important ones and put it in plain English using some common phrases we are all familiar with….. Continue reading