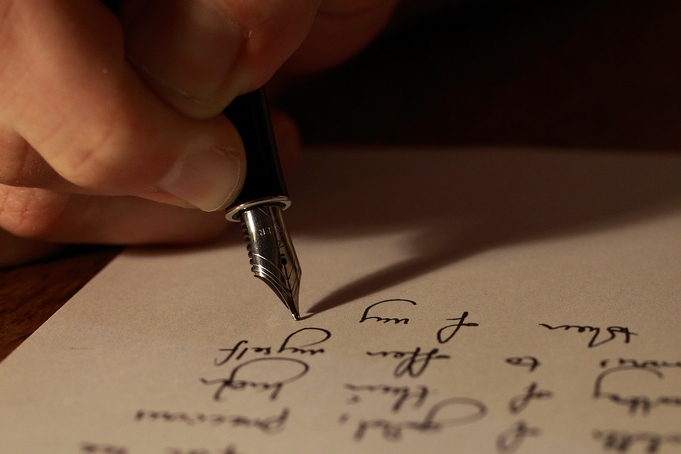

Dear Mr. Market:

If you’re watching an NBA basketball game and you have one player to take a final shot to win the game, who do you choose? Like him or not the guy who has scored the second most points in the history of basketball is LeBron James and he has made 50.5% of all shots he’s ever taken. Let’s switch sports to much worse odds, like baseball, where the average hitter is around .250 for a batting average. Even the best the game has ever seen was the great Ty Cobb who hit .366 for his career. Speaking of winning or losing, the mecca of odds making is in Las Vegas of course, and if you’re ever interested in losing money, just know that on average you can come out with a winning blackjack hand only 42.4% of the time.

New year, fresh canvas, but pretty much the same problems….So what are the odds of the market going up, down, or sideways in 2024?

Read more: Bulls, Bears, and Ballots: Election Years & the Stock Market Continue reading