Dear Mr. Market:

First off, if you want to know how amazing Artificial Intelligence is, the following list of article titles were generated for this article in the matter of four seconds! (we picked the first one and the rest of this article is typed with regular human toiling!)

FYI: If you’ve never used ChatGPT, before try it! Much of its delivery is on what and how you ask things and in this case here is the prompt/reply that we asked of it:

Certainly! Here are a couple of article title ideas that play on the “going long” football reference while discussing extending bond allocations, especially in a recessionary context and using the TLT ticker symbol:

- “Going Long in Two Fields: Why TLT Could Be Your MVP During Recessions”

- “Huddling Up for Stability: TLT’s Game Plan for Going Long in a Recession”

- “Scoring Big in Bonds: Going Long with TLT Amidst Recession Signals”

- “Touchdown for Investors: TLT’s Playbook for Going Long in Uncertain Markets”

- “Bonds and Touchdowns: TLT’s Strategy for Going Long in Recessions”

- “From Gridiron to Portfolio: Going Long with TLT’s Defensive Play”

- “Executing the Long Game: TLT’s Endurance in a Recessional Season”

- “Tackling Recession Risk: Going Long with TLT’s Defensive Line”

- “The Bond Field Advantage: Going Long with TLT Amid Market Turbulence”

- “Scouting for Opportunities: Going Long with TLT’s Recessional Defense”

Now…on to business and what we’re talking about today, which is not related to football but rather recession worries, market strategy, and in our opinion how one should consider adjusting the bond piece of their allocation to hedge what we see coming. If you’re in the growing and increasingly popular camp of preparing for a stock market crash or just a general recession, here’s one adjustment and hedge that you may want to consider.

To preface this belief (that we’re undoubtedly headed for a recession…since one is always technically coming anyway, but perhaps more so lately), most investors should not fall asleep at the wheel with their bond allocations. If you own an ETF covering the aggregate bond index, such as AGG, BND, or SPAB, we believe a portion of that allocation should be shifted towards the longer end of the yield curve. There’s a growing chorus of concern and rationale for taking this approach and for those that need a refresher of worrisome headlines, here’s a brief summation of our Top 10 Reasons to reposition a portion of your Bond ETF allocation:

(1) The stock market has opened the year on a decent run and is now running out of some drivers to push it higher.

(2) We have an inverted yield curve. Never in history has an inverted yield curve of this size not led to a recession.

(3) China (2nd largest economic engine of the world) is struggling and so is Europe.

(4) The Fed has stubbornly pushed the stock market towards a possible crash. Nobody wants to see this happen but we’re increasingly skating on thin ice with rate hikes and further Quantitative Easing (QE).

(5) The lag effect of high interest rates are starting to take hold on the consumer (housing, autos, credit card all have head winds).

(6) Retail as a whole is in a tenuous position and we’d be hard pressed to find one that is overly optimistic.

(7) The average family has witnessed a loss of earnings power and has less discretionary money to spend. Consumers also have to resume student loan payments in October. Additionally, a large swath of consumer built-up savings will be considerably lessened by the end of Q3.

(8) Does Mr. Market care about seasonality? Sure…sometimes, and the September/October time frame happen to be the worst two months for the stock market. We should also mention that shipments of goods through railways, ports, and trucking are all lower which is not normal for this time of year.

(9) Politics, Culture, and Fear…Never have we seen so much division, touched nerves, and people beginning to freak out. This may not end well and such a combination can have a synergistic effect on the markets should we get a sell-off or unexpected negative catalyst.

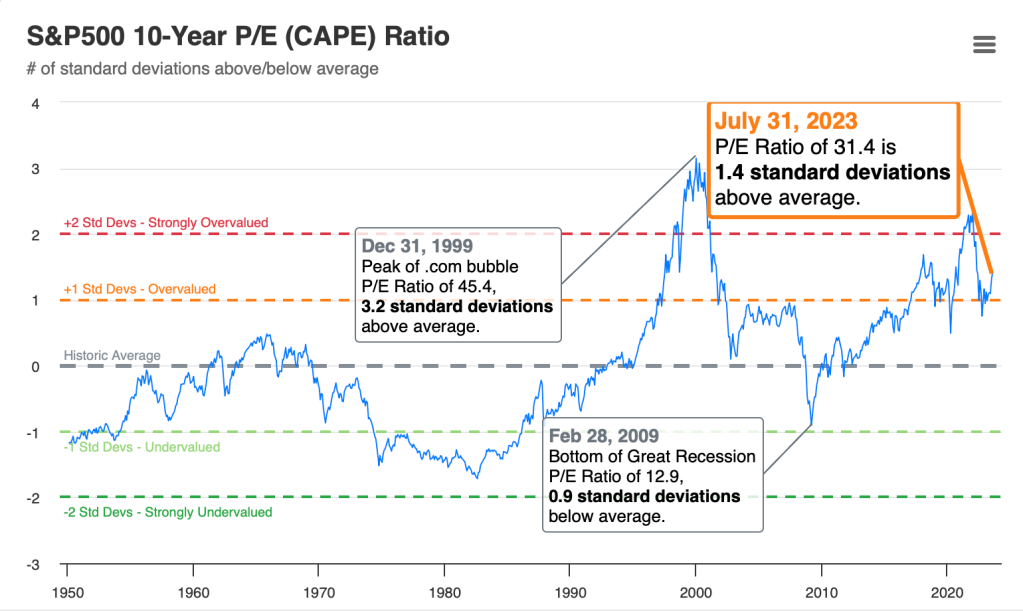

(10) Is the market overpriced? By some measures we’re certainly getting there. The chart below shows us where we are as of last month relative to past years.

Now let’s discuss strategy for your bond ETF allocation and why adding the iShares 20+ Year Treasury Bond ETF (TLT) can be influenced by a variety of factors, including credit events, economic conditions, interest rate changes, and market sentiment. Let’s briefly explore the potential scenarios:

(1) Credit Event or Recession: In times of a credit event or economic recession, investors often seek safety, and U.S. Treasury bonds, especially longer-term ones like those tracked by TLT, are considered safe-haven assets. During such periods, demand for U.S. Treasuries tends to increase, which can lead to higher bond prices and lower yields. TLT’s price could potentially rise (even substantially) in this scenario as investors move away from riskier assets like stocks and high yield bonds into the relative safety of government bonds.

(2) Strong Stock Market Performance: When the stock market performs well, investors might allocate more of their funds towards equities (“risk on”), which could lead to reduced demand for bonds like those tracked by TLT. Consequently, TLT’s price could experience downward pressure as investors seek potentially higher returns in the stock market.

Comparison with the Market and AGG: Comparing TLT’s performance to the overall stock market and the iShares Core U.S. Aggregate Bond ETF (AGG) involves considering their historical behaviors:

- Stock Market vs. TLT: In general, TLT and the stock market tend to have an inverse relationship. When the stock market experiences declines, TLT tends to perform well due to its safe-haven status. Conversely, during strong stock market rallies, TLT might underperform.

- AGG vs. TLT: TLT focuses on long-term U.S. Treasury bonds, while AGG tracks a broader index of U.S. investment-grade bonds, including corporate and government bonds. During times of economic uncertainty or interest rate declines, TLT might outperform AGG due to its higher sensitivity to interest rate changes and its safe-haven appeal. We might be early here with this type of a call and market strategy shift, but it’s one to strongly consider especially if you’re of the mindset that any one of the events / market themes we described above are happening.

So in summation, what should one possibly consider as an action step to incorporate TLT into their current bond allocation? For a typical “60/40” mix (60% stocks and 40% bonds) allocation, we at My Portfolio Guide, LLC are tapping the brakes slightly on the equity portion but the main adjustment would be to reallocate the bond percentages using an example mix of the following ETFs (and of course sticking with our trusty gold index) as a further hedge:

Example Allocation:

- Equities: SPY: 50% (assume a starting mix of 60%)

- Bonds (plus Gold):

- Gold (GLD): 10%

Enough banter on allocations and going long TLT. For those football fans out there, you can go back to the game and hopefully do so with a feeling of being better prepared if things progress as we think they may.

This seems like a significant shift to the bearish side, even compared with your last newsletter, and has me thinking.