Dear Mr. Market:

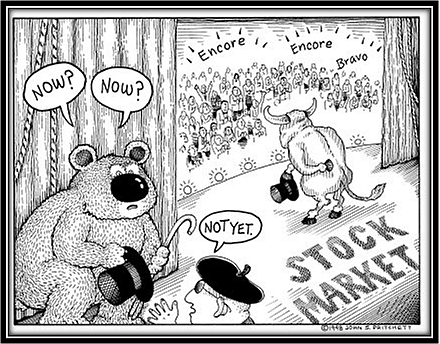

You’ve been around long enough to know that the smartest people in the room are not always the most profitable ones. Case in point: Michael Burry just published what may be the most meticulously researched bearish manifesto since… well, since his last one.

Let’s give credit where it’s due. The man called the 2008 housing collapse with surgical precision, bet his career and his investors’ capital on it, and was right while everyone, including his own clients, thought he’d lost his mind. That’s not luck. That’s genius. If you haven’t seen The Big Short, go watch it. Then come back.

But here’s the thing about genius: it doesn’t come with an expiration date stamped on the worry.

Continue reading