Welcome to the fifth year of our March Madness Investing Bracket! This series of articles is always one of the most popular investing articles on the internet! We’re proud to admit that we were one of the first investing nerds to combine our love for the markets with the passion that college basketball brings!

Welcome to the fifth year of our March Madness Investing Bracket! This series of articles is always one of the most popular investing articles on the internet! We’re proud to admit that we were one of the first investing nerds to combine our love for the markets with the passion that college basketball brings!

It’s common knowledge that people love excitement and surprises. It’s also human nature to root for the underdog and many times those two themes can certainly play out on the basketball court as well as on the stock market floor. Much like two college basketball teams that never play each other our imaginations are swept up in wondering who will “win” between a relatively unknown investment or a popular stock that has the media in a frenzy.

You may be asking what does a basketball tournament have to do with managing your portfolio or the investment world in general? At first glance there might not be much but we thought we would have a little fun and couple it with some asset allocation parallels. After all, there are many folks who have simply thrown their hands in the air at one time or simply succumbed to the notion that investing is like educated gambling. There could be some truth to that depending on your approach…

For those of you that are not familiar with the NCAA and its annual basketball tournament there are 68 teams selected and each is seeded according to their results throughout the regular season and their relative rankings. Every March the NCAA holds a single elimination tournament to crown an undisputed champion. Part of the appeal of such a tournament is that theoretically any team that makes the “big dance” has a shot at winning it all. Each and every year there is a proverbial “Cinderella” team that surprises everyone including all the ‘so-called’ experts. Prior to the tournament there is always plenty of banter and opinion on who wasn’t invited or further arguments around the seeding of the teams that did make it. That’s where we see a parallel of sorts to investing and having to make decisions among the multitudes of investment choices. With so many investment choices available, there are also as many differing opinions.

In the “real” March Madness tournament this year there appears to be a hands down favorite with the undefeated Kentucky Wildcats. Hardly any office pool or basketball analyst is betting against such a heavily favored team. If they win it all it will be the first time in over 30 years that a team stays unbeaten the whole season. Our own version of this (using investment themes and choices) shares the premise that we have four very decent #1 seeds but there is no slam-dunk pick that everyone agrees on. For this reason, our 2015 bracket is perhaps as important as ever to understand that a dark horse could win it all…

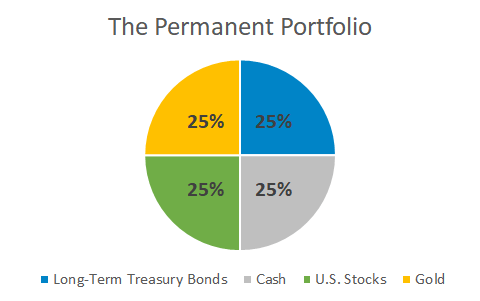

Before we begin digging into each “region” of our bracket, let’s revisit something everyone claims they know but so very few actually follow with consistent discipline. (Asset Allocation)

If you have ever looked at a chart of all the different asset classes and how they perform year to year…there is rarely a pattern or consistent way to determine next years “winner”.

For the purposes our annual investing bracket we have “seeded” or ranked four major asset classes (like the regions) and chosen several individual picks within each. There is some basic science applied to this process. We consider how the “pick” did over the past 12 months and also how it has trended over the past three months. In some cases we gave a lower performing investment a higher seed if it was trending well with recent strength or was more consistent over a longer period of time.

Each asset class (Large Cap, Small Cap & Mid Cap, Bonds/Alternatives, and International) was ranked and seeded, then corresponding seeds were assigned to “picks” that we are either adding to the portfolio or establishing new positions in. Note that we’re not highlighting 68 new investments and will only discuss some investments that we are either actively involved in or looking to add to most portfolios.

OK…Let’s dig into some of the key match-ups and explain why our Final Four going into Q2 2015 looks the way it does (CLICK HERE to view our 2015 Bracket):

Large Cap

This is typically viewed as the ‘efficient’ asset class. Continue reading →