Dear Mr. Market:

The past two months in the stock market have been treacherous and truly tested the average investor’s nerves. Most of us are close to being “fed up” with the headlines, inflation, political division and ensuing market volatility. Before we get into the headline of the day, let’s quickly touch on the operative word, “Fed” and how completely wrong the Federal Reserve has been at just about every turn. The following timeline comes from The Kobeissi Letter, an industry leading commentary on the global capital markets:

Read more: Fed upThe Fed Since 2020:

1. Mar 2020: Inflation won’t be a problem

2. Jan 2021: Inflation is “transitory”

3. Sept 2021: Interest rates won’t rise until 2024

4. Jan 2022: Recession is needed to lower inflation

5. Dec 2022: Disinflation has begun

6. Feb 2023: A “soft landing” is possible

7. Mar 2023: Banking system is “stable”

8. Sept 2023: Inflation won’t hit 2% until 2025

Not a single statement above was correct. Has the Fed lost all credibility, just prone to mistakes, or are they purposely managing to a desired outcome?

Now, as we wrapped up the worst month and quarter of the year, what can we expect going into Q4? First off, the last four Septembers looked like this:

2020: -3.92% 2021: -4.76% 2022: -9.34% 2023: -4.90%

But what happens afterwards is interesting and worth taking note:

The last three Q4s: 2020: +11.69% 2021: +10.65% 2022: +7.08% 2023: ?

Before we share how we read the tea leaves for what’s in store for Q4 and the finish to 2023, let’s quickly address the latest “sky is falling” headline; the looming government shutdown.

First and foremost, we’ve seen this movie before! We’re not watering down the headline fears but rather putting them into context. If one listens to the media it’s as though this event has never happened. Mark Twain perhaps said it best with his quote of “history doesn’t repeat but it does rhyme”…in this case, however, it has repeated and will undoubtedly continue to do so. The government has indeed shut down before and quite frankly seems to do so more often than not over the past few years. We won’t spend too much time on this now but if you want to brush on up the facts, the government has shut down 14 times since 1980 alone! Click here for a quick revisit of that timeline.

Even if (and when) we see this transpire, federal activities (and employees) deemed “essential” will continue to draw from the national treasury. Examples include national security, border patrol, law enforcement, disaster response etc. What matters more (at least with how the markets react to it) will be just how long it lasts. A shutdown of under two weeks would have minimal impact since federal employees would still get their paychecks on time. However, longer shutdowns are typically coupled with providing back pay to bureaucrats and congressional staffers. Accordingly, the actual adverse effects of a shutdown would be much less than the fear mongering that often is presented to us through 24/7 media coverage.

Once we get through this, and we will…what can you expect after the recent stock market drawdowns? As we’ve alluded to, thus far 2023 has truly played into the seasonality trends. While one can’t simply get in or out of the market based on what it’s done in years past, there is some credence to paying attention to it…especially if “history is rhyming” as much as it is now. Earlier in the year, contrary to almost every economist and financial pundit, we said 2023 would be a positive year and it certainly started that way. This was not a popular stance to take after a brutal 2022 but pre-election years are typically strong and that’s exactly how it panned out. Third quarters in pre-election years, however, do not do well historically but then what happens afterwards is very much worth paying attention to.

Bottom line, and we will say it clearly here…barring some truly black swan or unprecedented type event, we will finish higher in Q4 and have a positive 2023.

(The following set of graphs come from Chief Market Strategist, Ryan Detrik).

First off, the 4th quarter is historically the strongest by far:

Secondly, back to a natural pause and consolidation period that has occurred in pre-election years, we’re seeing exactly that right now:

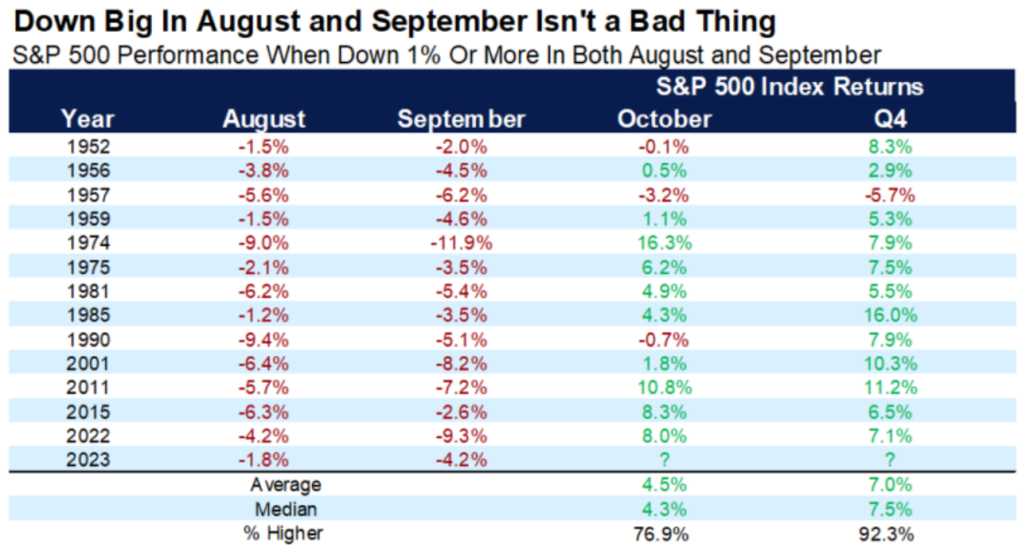

Additionally, after we’ve seen two consecutive down months in both August and September, look what happens in October and the rest of Q4:

So, in summary, there are plenty of worrisome and somewhat repeated headlines to take stock of, but do not rule out a better Q4 and finish to the year, but rather you can bank on it. Mind you, October may start off negative or carry over some of the August and September hangover, but be patient, reallocate if need be, and maintain your strategy in spite of what will potentially be a noisy next few weeks.

Lastly, and back to us all being “fed up” with the Fed, fret less about their prognostications and basically mismanaged guessing game. Yes, there will be a recession; there always is one coming but there is always a recovery as well. Never try and time the market just based on seasonality, but again, pay attention when it’s lining up like we think it is and have exhibited above.

“Far more money has been lost by investors in preparing for corrections, or anticipating corrections, than has been lost in the corrections themselves.”

-Peter Lynch