Dear Mr. Market:

Guess what? You win. Yes…Mr. Market, you win! It won’t take another bear market or adding further gains to recent stock market highs for you to prove to us that no matter what the environment is you are going to make fools out of many brilliant people.

The beauty of your victory (at least for you) is that there will always be a market and a debate to engage in. The age old argument of “Active versus Passive” will rage on indefinitely.

Active Money Management (hands on approach with the goal of beating markets and taking advantage of short-term price fluctuations)

In one corner we have the ‘crystal ball crowd’ that thinks they can outsmart you and time the stock market. “Buy low and sell high”, right? If only it were that simple and if only someone could get it done successfully more than once. Mr. Market has us human beings in the palm of his hand because he knows we all have one thing in common; we’re emotional creatures! Some of you will read or hear news and act on it. Worse yet…you’ll rely on your gut instincts or a “hunch” because after all you were right once before. You are Mr. Market’s perfect candidate…Take another sip of false confidence and brace yourself for his eventual knockout punch which you won’t even see coming.

Passive Money Management (hands off approach with a goal of matching markets by using index funds/ETFs and not reacting to every market move)

On the other side of the room is the buy and hold crowd (or sometimes the ‘buy and forget’ group as we like to call them). Sure…on one hand a true investor should indeed be patient and allow an investment to pan out over time. Some clever sayings come to mind such as “It’s about ‘time in the market’ not ‘timing’ the market.” While we lean towards this overall investment philosophy there are times when it can go drastically wrong. If you have a lump sum or healthy chunk of cash right now and we’re at all-time stock market highs, do you just dump it all in right now?

So this leaves us to ask what the ultimate answer is to the question: Which is best…Active or Passive money management?

The foundation for any well performing portfolio is its asset allocation. We’ve written extensively about this before but over 90% of a portfolio’s performance is determined by how it’s allocated. Another way of looking at this is that you could pick poor individual investments (stocks or funds) but be in the right areas (asset classes) and do just fine. Like all things in life there needs to be a balance between discipline and the ability to adapt to changing environments in order to truly be successful. We believe we have found this with an Adaptive Asset Allocation Strategy.

Columbus Adaptive Asset Allocation Strategy

Over the past year My Portfolio Guide has been working with Dimensional Research and its development of the Columbus Adaptive Asset Allocation Strategy. We are proud to announce a formal engagement with them and in doing so will be exclusively offering the Columbus strategy to our clients as part of our investment platform.

The Columbus Adaptive Asset Allocation Strategy is a quantitative methodology that is designed to adapt to the markets as they constantly change. While it’s suited for clients seeking equity like returns, one of the primary goals of this strategy is to minimize drawdowns during rough markets. It’s ideally positioned for portfolios over $100,000.

What’s under the hood of the Columbus Strategy?

First and foremost, as big fans of ETFs we wanted a strategy that would be able to use widely recognized ETFs that were liquid and also in most cases commission free under our Institutional arrangement with TD Ameritrade. The strategy consists of a universe of 15 ETFs representing major asset classes. It rebalances once per month and can invest in up to eight ETFs depending on what the algorithm is positioning the strategy for relative to the market environment. Click this link Columbus Strategy Overview to learn about which specific ETFs it uses as well as some unique aspects to how we have set maximum exposure limits on each asset class.

It is possible for the entire portfolio to take an extremely defensive posture and only be in one asset class (cash). The strategy dynamically adjusts and rates each ETF on volatility, momentum, and the overall correlation of returns to the portfolio. We’ve long said that it’s easy to buy investments but very few people are adept at selling them. The proprietary algorithm in this strategy is primarily designed to reduce the risk of huge drawdowns while still trying to capture market upside when appropriate. The main goal is to achieve the most optimal risk-adjusted return.

Behind the Numbers: (Performance and most recent Monthly Rebalance)

Speaking of returns…just how well has the Columbus Strategy performed? Not only is performance where the “rubber meets the road” but the summary below gives you a concise snapshot of how we’re positioned in September. (click link below to view)

We plan to report performance each month but in order to be fair to our loyal clients in the strategy…regular readers will see the rebalance on a one month delay. (we can’t give away the “secret sauce”!) If you’re interested in receiving the reports when they’re first published or want us to manage one of your portfolios using the Columbus Strategy contact us via phone at (888) 474-8433 or email your inquiry to info@myportfolioguide.com.

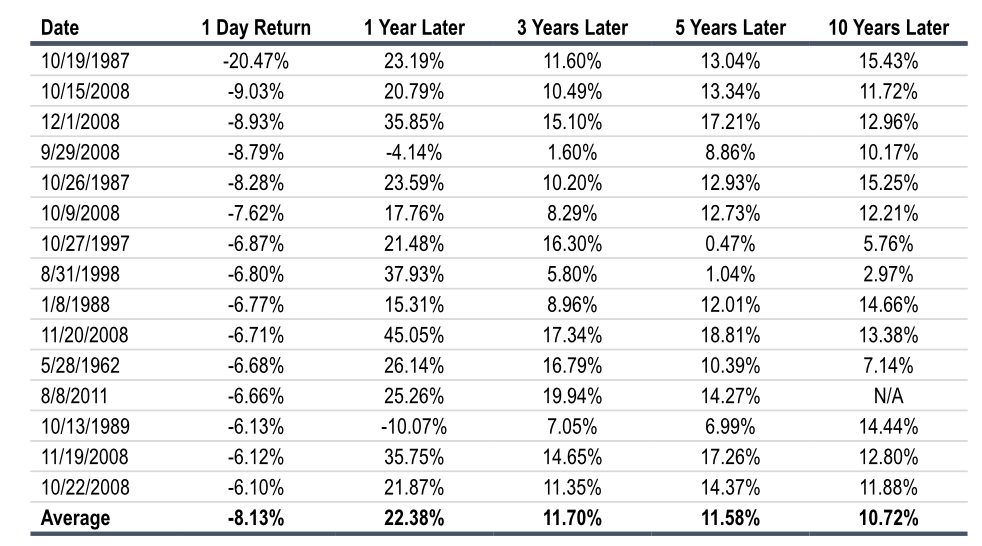

Obviously the Columbus Strategy boasts some impressive returns. Back testing the strategy to May of 1998 you’ll note it returned +10.51% annualized returns versus the S&P 500 at +9.37%. Comparing it to a more diversified benchmark we have chosen to track it relative to the GMO Global Asset Allocation Fund (GMWAX) which over this same time period returned +3.92%. The main reason this strategy has grabbed our attention is not just for beating the markets long-term…but rather on how well it played defense during turbulent times. The Columbus Strategy had drawdowns under -10% relative to the Global benchmark at -31.87% and the S&P 500 at -51.49%!

What about during REALLY bad markets?! (Dot-Com Crash and the Financial Crisis)

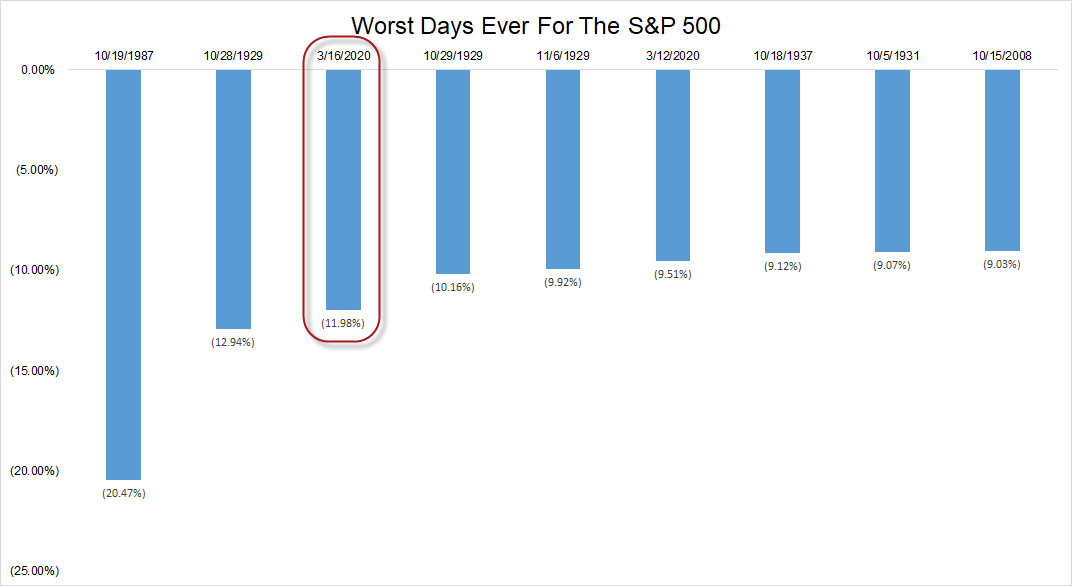

Side stepping one or two rough stock market patches usually is at the core of hot marketing strategies. A real strategy is one that can exhibit repeatable characteristics in all sorts of different crises and especially so during ones that were brutal. Perhaps there are no two better examples than the Dot-Com Crash and the Great Recession/Financial Crisis of 2008. Columbus_Historical_Events_Analysis on how the Columbus Strategy did during those historical events. It’s remarkable how the portfolio shifted to less volatile asset classes such as cash/money markets and Fixed Income (bonds/treasuries etc). For a more detailed look and an overlay versus the S&P 500, specifically look at pages 3 and 4 in the above link. Lastly, we’ve also had this strategy back-tested* for other unique events such as the stock market crash of 1987. Contact us for details if you’re curious about a specific time period or market event.

*Keep in mind that for some older back tests the strategy had to use proxies for the ETFs since many did not exist at that time. For your reference click this link to see a list of those proxy funds Columbus Proxy Mutual Funds Universe .

In summation, we’re extremely proud and excited to offer this dynamic investment strategy! Our next report on the Columbus Adaptive Asset Allocation Strategy will be an update at the end of the month. You’ll see a report tracking how a $1 million portfolio is performing using this exact strategy. Again, seeing actual trades and real-time rebalancing will be reserved for our clients but feel free to inquire for more details or get set up to have your account managed professionally. Obviously not every investor is a match for this type of portfolio management but we would bet that it likely beats what you or your current financial advisor are offering you now!

Have a great remainder of the month and see you next time!