Dear Mr. Market:

The investment industry is notorious for not being transparent with investors. The industry tends to be a shade of grey as opposed to being black and white. There are often hidden agendas or conflicts of interest that the average investor is never aware of or informed about. Think back to some of the situations that have negatively impacted investors in just the last few years: Bernie Madoff, Insider Trading, the Mortgage Industry debacle and the meltdown of Enron! Conflict of interest is essentially why the Sarbanes-Oxley Act is now in existence.

Conflict of Interest – Occurs when an individual or organization is involved in multiple interests, one of which could possibly corrupt the motivation. (from Wikipedia).

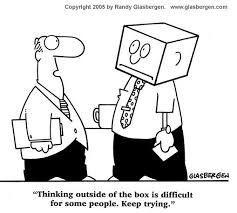

![]() Today we will take a look at an investment firm that has had incredible growth over the last several years: Windhaven Investments.

Today we will take a look at an investment firm that has had incredible growth over the last several years: Windhaven Investments.

In 2010 Charles Schwab & Company (SCHW) purchased a small investment advisory firm in Boston named Winward Investments. The firm’s strategies had posted impressive results for several years and didn’t use the industry standard ‘buy and hold’ type of approach. They used primarily ETF’s (Exchange Traded Funds) and claim to invest in over 40 different sectors, participating in positive markets and protecting in downturns. Schwab paid a hefty price for the firm, paying $150 million in cash and stock (source: WSJ). Continue reading

In 2010 Charles Schwab & Company (SCHW) purchased a small investment advisory firm in Boston named Winward Investments. The firm’s strategies had posted impressive results for several years and didn’t use the industry standard ‘buy and hold’ type of approach. They used primarily ETF’s (Exchange Traded Funds) and claim to invest in over 40 different sectors, participating in positive markets and protecting in downturns. Schwab paid a hefty price for the firm, paying $150 million in cash and stock (source: WSJ). Continue reading