Dear Mr. Market:

Nobody likes traffic but it’s without question a part of our daily lives. Being stuck behind a long line of cars and seeing nothing but red taillights is even more aggravating when you are short on time and need to be somewhere soon. Many of us try to do whatever we can to avoid traffic; whether it be leaving earlier, taking side streets, carpooling, or relying on tools like GPS apps that show us the best routes to take. What does this have to do with investing? Everything…

If you haven’t yet learned or heard why the freeway is perhaps the most important analogy for the success of your portfolio…you need to commit this article to memory. Your local freeway can teach you why 90% of your portfolio’s performance is dependent on what lanes you choose to drive in and only 10% on how fast your car is.

Take for example, Interstate 405 in Los Angeles…which happens to be the busiest stretch of highway there is in the nation. Let’s say you need to get from Long Beach to LA in what normally takes about 30 minutes. You hop in your car and hit the fast lane and seem to be making great time averaging 65 mph. No sooner than about 10 minutes into your drive your lane comes to a screeching halt. After about almost a mile of grinding away at five mph you decide to switch into the lane to your right which is now flowing much faster. Almost within seconds of doing this, the lane you were just in passes you by! Your 30 minute trip to LA will now take you at least an hour and possibly more at this pace.

This simple but nightmarish traffic scenario happens daily to over 400,000 drivers along the 405 but it also absolutely ruins millions of portfolio every year! Pretend each lane of the freeway represents an asset class. (ex: Large Caps, Small Caps, International, and Bonds) On any given year one “lane” (or asset class) will lead the markets but the likelihood of it doing so the next is rare and if you look at historical returns there is no discernible pattern. CLICK HERE to review how asset classes have performed each year from 1994 to 2013:

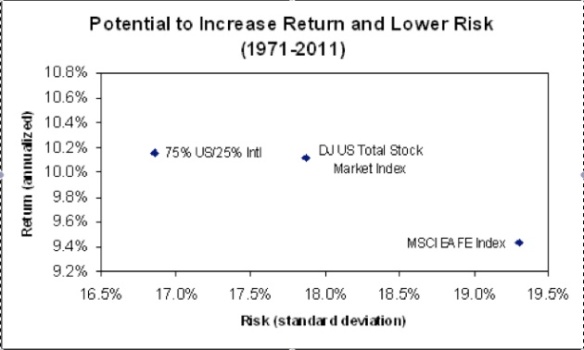

One of the better examples of this is Emerging Markets in the early 2000’s.

The BRIC’s (Brazil, Russia, India, and China) were all the rage from 2003 until 2007. Hardly any investors had the courage to step in until late 2007 because they were still licking their wounds from the “dot com” crash. Many people hid in cash or gravitated to Bonds which turned in a +10.26% year in 2002.

Over the next four years Bonds Continue reading →