How is my portfolio doing this year? Am I on track for retirement? Why is the market up big but I’m not? What would my portfolio look like if the market tanked again like it did in 2008? I’m in cash right now because I feel stocks have moved too high but I don’t trust bonds because we all know where they’re headed.

These are some common and very typical questions many investors are asking themselves this year. If any one of these questions applies to you or feels familiar, don’t think you’re alone! One common thread among all these questions or concerns is benchmarking. What exactly is a benchmark and which one is appropriate for you?

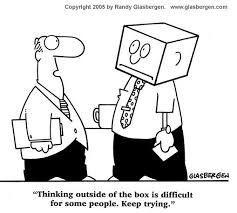

Far too often investors compare themselves to other investors, strategies or benchmarks that are completely unrealistic. Investors need to take the time to truly understand who they are and what their goals are before they compare themselves to anyone or anything! Let’s put this in perspective…. Let’s say you decided you wanted to start swimming to get in shape. Would you expect to get in the pool and swim times comparable to Michael Phelps (winner of 22 Olympic medals) within a couple of weeks? Of course not… that would be ludicrous and clearly not the right athlete to try and compare yourself to! As crazy as this sounds many investors have similar expectations with their investment portfolio. Continue reading