Dear Mr. Market:

We have discussed many times how emotionally driven you are. On some days you tempt us with your record setting high wire acts and on others we have our lips virtually wrapped around the barrel of a gun in desperation; the stock market is a wicked playground.

We don’t believe that computers or sophisticated investment algorithms can completely mitigate the perils of the stock market or protect everyone from getting out of their own way, but it can at least be used as a starting point. My Portfolio Guide relies on some very unique tools that assess the stock market each month with a fresh set of eyes. While our method of “reading the tea leaves” is not necessarily a crystal ball, it’s definitely not what most investment advisors use….which is the rear view mirror. Sadly enough, many investment advisors are just like you…they’re human and they chase recent returns and mistakenly look back in history as to what has done well. While this method of analysis is the easiest to sell clients (and themselves) it’s not as effective as taking a completely fresh look at what is happening right now and how that is statistically likely to play out in the near-term.

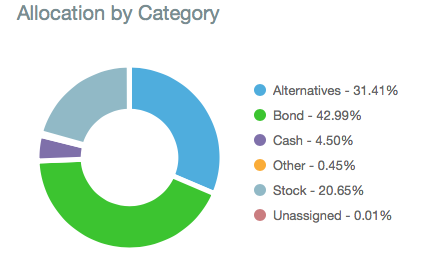

My Portfolio Guide’s signature investment strategy, the Columbus Adaptive Asset Allocation Strategy, is driven by such an algorithm and it’s interesting to note that we’ve been in a defensive posture for almost the past three months. While this doesn’t necessarily mean we believe we’re headed for a bear market, the shift out of equities since March has clearly signaled that reaching for near-term upside does not warrant taking on more risk or increased volatility. Earlier in 2018 the Columbus Strategy was over 72% allocated towards stocks and we saw a drastic shift away from them in April and May (down to 20.65% and 16.15% respectively).

If you’ve ever lived in Southern California the term “June Gloom” is more than a rhyme…it’s a real weather condition. We don’t enjoy being a joy kill so understand that is not point of this article, but the way June is shaping up we’re content with how Columbus has us positioned.

Uncertainty is still in the air and as we all know that is perhaps the number one ingredient that Mr. Market does not care for. The month opened up with more volatility due to Italy’s political crisis and how that could impact the Eurozone. We quickly moved off of that to banter about whether any meeting would materialize between President Trump and Kim Jong-un of North Korea. The latest news was of course more discussion around another interest rate hike. Long story short…there is plenty for Mr. Market to have us talking about and our Columbus Strategy has effectively decided to hit the mute button for at least a few more weeks.

While the model is not completely out of stocks it’s also interesting to note that a shift in asset classes amongst equities took place. Only our clients will see the specific percentages but a fairly meaningful position rotation from Large Cap to Small and Mid Cap equities occured. Large Cap had been the answer last year but for those who are nostalgic and miss being in this popular asset class…you haven’t missed much. Columbus has actually kept up with the S&P 500 but done so with less overall volatility and to us that’s one of the main objectives of the strategy.

The most major change that we see our Columbus Strategy establishing is a very sizable position towards the US Dollar Bullish Index ETF (UUP). With all the global uncertainty and the Trump stimulus passed earlier this year, there has been some momentum fueling the dollar’s rise. How long this will last we don’t know but for now we’re in a position to take advantage of it and the model is signaling it to be more worthwhile than being heavily exposed to stocks. Lastly, we reduced our exposure to Gold (GLD) but continue to hold near our maximum allocation that the model allows towards Commodities (DBC) at 25% of the overall portfolio.

Until next time friends… and regardless of what the stock market gives us…we wish you a bright, safe, and enjoyable summer!